In a dynamic discussion at Insurtech Vegas, Steve Gaertner, Head of North America at ReMark, engages with Nelson Lee, Founder and CEO of iLife, to explore the transformative impact of digitalization on acquisition(ROI) in the insurance industry.

Steve Gaertner: Tell us about iLife and why you’re here.

Nelson Lee: We’re a B2B SaaS company. We build front-office software for insurance Carriers and Distributors. We’re here today to talk about insights for high ROI on acquisition.

Steve Gaertner: What would you observe about iLife’s experiences within the growth of the Insurtech Industry?

Nelson Lee: I think there is a much bigger emphasis in B2B on how technology will not necessarily replace certain jobs or people or functions, but empower people, and enhance their experience, workflow efficiency, and productivity.

You can grow by helping others. What I think about innovation is it never should be a zero-sum game, because it’s not.

Steve Gartner: How do we get more people into buying life insurance, in particular health or annuities?

Nelson Lee: Many carriers are challenged today with bridging these human-led channels, with digital technology to enhance the overall user interface between the producer, the consumer, and the Carrier.

From a Carrier perspective, the biggest opportunity is recognizing that not only do you need a better digital interface and experience, but also to improve the way humans fundamentally interact with each other, period.

For example, you and I can interact digitally through our phone and in a variety of ways, but that’s not the only way we interact. We also have offline ways of interacting, right? We might go grab dinner or grab a coffee.

I think Carriers need to capture that nuance where it’s an online and offline combination and they need to enhance the experience of agents and their clients with such context in mind. It’s not just all paper and offline or just all digital. Humans don’t behave in extremes.

Steve Gaertner: From a Carrier perspective, facing these challenges, why should Carriers prioritize this sort of activity in terms of the UI to enhance the customer journey for the purchase of insurance?

Nelson Lee: Convenience is a very important factor in a good experience. Most distribution relies on humans, agents, and brokers.

And if you make it a good experience for agents and brokers, that’s usually also a better experience for consumers. And that means better business for the carrier. So in a way, there is no reason this shouldn’t be a top priority all the time because it directly impacts your top and bottom line.

So when it comes to digital acquisition channels, I’ve observed that Carriers often experience various levels of disconnects in terms of that impact sales growth at the end of the day.

Steven Gaertner: So what what’s one of the benefits in your mind of building a universal e-App product experience versus how things are architected today?

Nelson Lee: I think there are technical engineering advantages, but I think more importantly, putting all that aside… just from a human interaction perspective, if I wanted to buy three things from Steve and Steve gave me two options:

Option A: I did one thing I could buy all three things.

Option B: Do the same process three times separately.

Option A is going to be a better experience for the agent, your seller, and arguably the clients of an insurance carrier and the end consumer.

So a Universal e-App experience is always going to result in a superior way of attracting both your distribution force and the end consumer.

Steve Gaertner: So, I’ve witnessed significant investments being made. Then the initiative falls short because of the longer implementation cycles, the tech not being used or adopted, or even maximized if it is adopted. What advice would you have for Carriers when investing in solutions for agents in this sort of track?

Nelson Lee: First, in selecting anything for agents, it’s agent feedback and their core KPIs that matter. Core KPIs are things like, “Hey, is I helping them acquire customers more productively with their time?”

So there’s the feedback and happiness of your users and customers. The other thing is implementation times. I think it’s important to think about things like: why are systems taking so long to implement if it’s that difficult, is that hard to implement? Is it going to be that convenient?

Newer technology in theory should be more convenient for everyone.

Steve Gaertner: So we talked about efficiencies and solutions for agents. What are the broader organizational benefits for a company, whether it’s a Carrier or a Distribution Group, an IMO or bigger?

Nelson Lee: For Carriers, I think if you have a very modern and universal tech stack in your acquisition funnel, the acquisition, no matter how you acquire a customer, all leads to an application for insurance.

If you have a Universal e-Application for, say, five or six product lines and potentially 20 different products, you are by default managing fewer tech stacks and different software. It’s way cheaper to just manage one good tech stack than five, six, seven, or 20 different tech stacks. Also, it would take a lot less effort and time to maintain.

Sometimes people don’t realize the total cost of ownership is not just what the software costs to the vendor. A lot of it is: “How many people do I need to maintain this?” That could be just as expensive, if not more than the actual software.

So the labor cost, let’s call it, manpower to maintain all of these systems, is often exponentially more expensive than the actual system itself.

So from a Carrier perspective, you’ve got these considerations, not only the investment on the front end, the maintenance cost ongoing, but also I would think that there’s an inherent benefit to an all-in-one approach: agent satisfaction, distribution, satisfaction, and that goes to retention, keeping good people on your team, and selling with a platform that helps them do more and efficiently.

Plus, retention. Retention is a function of convenience and happiness. For example, if I’m an insurance company and you’re an agent, I want to recruit or retain, I give you two options. One, “Hey, Steve, if you want ten apps on your phone, you’re going to have to buy ten phones.” Well, I think you’re going to be pretty annoyed with me, right?

You’re going to put up with me for some time and then you get pretty annoyed. And then, if my competitor goes, “Well, Steve, you’ve got ten apps. Just put all ten apps on one phone.” Then you’re going to be like, “Wow, that seems much easier.”

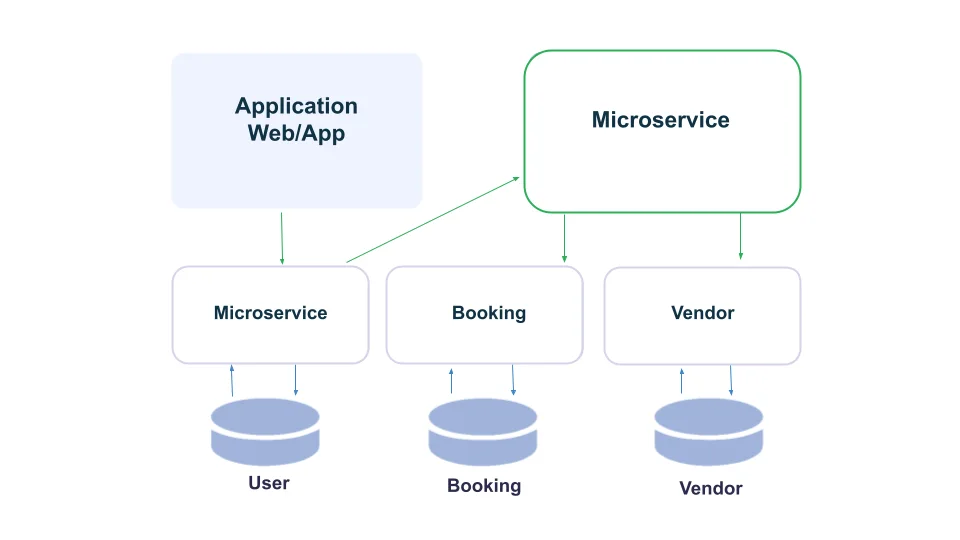

I think another significant advantage iLife has is newer technology. Native tech support is when everything’s cloud, native, and containerized, and it’s much harder for something to break platform-wise significantly.

With older software, very often one small thing breaks or you make one small change, and then you have a chain effect where it affects everything else you had never thought of. Then the whole thing’s down and you have downtime. For a large insurance company, 2 hours of downtime is very expensive.

Whereas with newer technology, typically new code is written in a way where you can have independent small bug failures, but it doesn’t affect the rest of the platform, and that translates into reliability. Reliability is a huge part of ROI because you will have no ROI if what you’re implementing isn’t working, right? If it’s not operational, the ROI would be zero or negative.

Steve Gartner: So I think in closing, I’d like to say thank you for joining on having our conversation here. We’ve been working together for about ten or 12 months here, and I’m excited about the growing partnership between iLife and ReMark and how we can change the marketplace together.

Discover how iLife’s e-Applications have set a new benchmark in insurtech, offering streamlined processes, unparalleled efficiency, and a seamless user experience.